Today, an increasing number of people are choosing to keep pets to find joy and comfort in life, and pet owners are willing to spend more time and money to provide their pets with the best care and services. This trend has created significant business opportunities and growth potential for the pet supplies market.

The pet industry encompasses two major product categories: pet food and pet accessories/supplies. Due to the thriving pet market and stringent food regulations in Europe and the Americas, these regions have established higher production standards and superior material selection in pet food manufacturing. As a result, China’s pet products hold a notable competitive advantage in international markets.

China’s pet products economy is booming at an unprecedented pace, with the industry scale exceeding 600 billion yuan in 2023, with the products segment accounting for 50 billion yuan. It is projected that by 2025, the overall market size will surpass the 800 billion yuan mark, with an annual compound growth rate exceeding 15%.

Decoding China’s Pet Supplies Factory Clusters

China’s pet products supply chain has formed three core industrial belts:

- Hebei Industrial Belt: Focusing on pet food, Xingtai’s Nanhe County is hailed as the “Hometown of China’s Pet Food Industry,” contributing over 60% of global pet chew toy production capacity and accounting for 30% of national cat litter box output.

- Shandong Industrial Belt: Leveraging agricultural resource advantages, it clusters leading enterprises such as Yantai Zhongchong and Guaibao Pet, forming a complete food supply chain from raw materials to finished products.

- Jiangsu-Zhejiang Industrial Belt: Known for innovative design and foreign trade, Pingyang holds a 60% global share of pet chew toys.

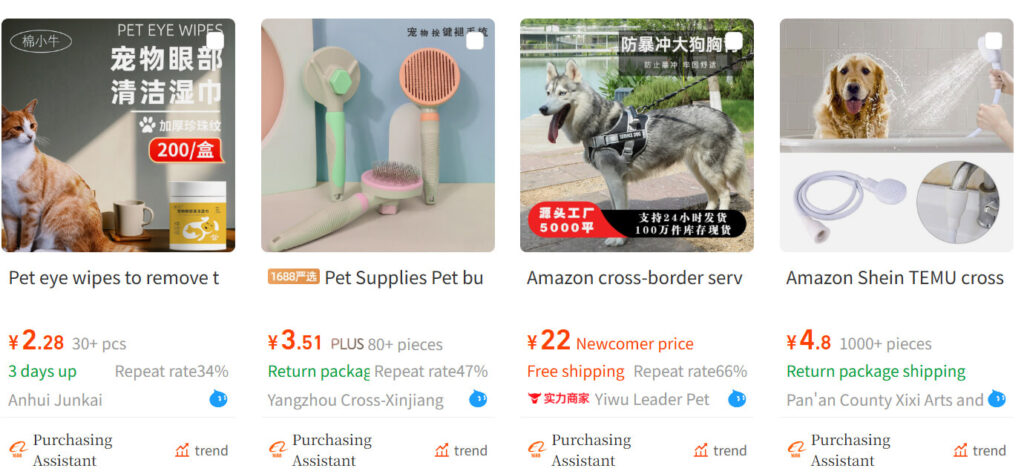

Wholesale market networks span the nation, including 1688, Alibaba, Foshan Dali New Town South Market (China’s largest pet wholesale market), and Yiwu Pet Products International Market (leveraging the small commodities ecosystem).

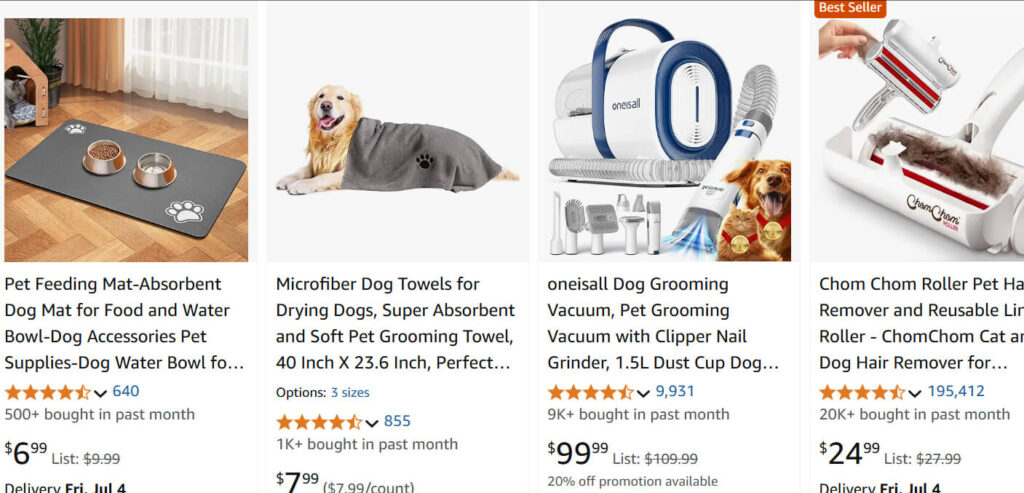

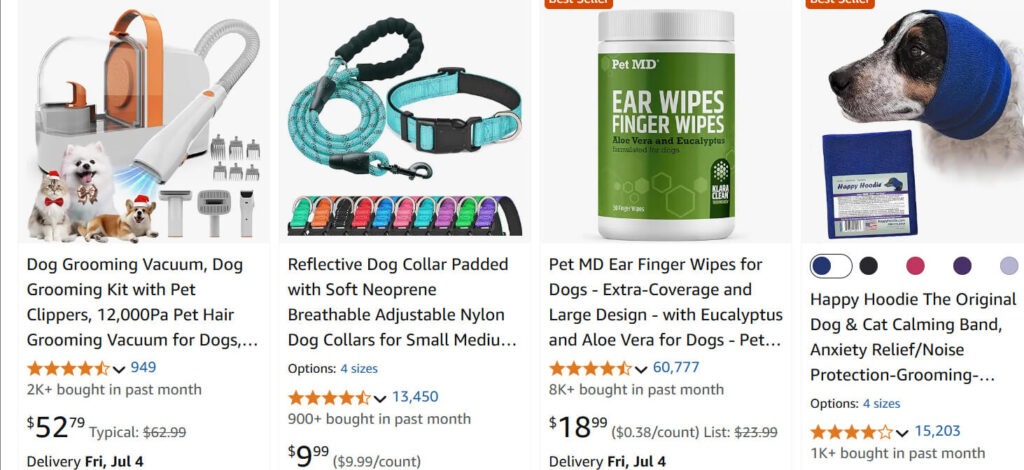

Top-selling products of global pet supplies

China’s supply chain covers core categories throughout the entire pet life cycle:

- Wearables: Holiday costumes (New Year’s outfits, lion dance costumes), functional raincoats, smart tracking collars, etc.

- Home essentials: Smart bedding (temperature-controlled materials), automatic feeders, cat trees, eco-friendly litter boxes, etc.

- Healthcare: Flea and tick preventative drops, pet blood pressure monitors, specialized nutritional supplements, etc.

- Cleaning and grooming: Hypoallergenic shampoo, pet dryers, electric grooming tools, etc.

- Entertainment and toys: Stress-relief toys, educational maze balls, durable chew toys, etc.

Why global merchants prefer sourcing from China?

- Unbeatable value for money: U.S. buyers are price-sensitive, and Chinese products offer a 30%-50% cost advantage over European and American brands while maintaining quality.

- Deep supply chain integration: Clusters like Pingyang chew toys and Xingtai cat litter achieve **minute-level production response**, while the Yiwu Small Commodities Market offers one-stop shopping for all categories.

- Accelerated innovation: Data from the 1688 platform shows that the design-to-production cycle has been compressed to 7 days, faster than the average 3-month cycle of international brands.

- Mature cross-border e-commerce: Platforms like Amazon, Wish, Shine, and TikTok connect logistics to over 200 countries, allowing overseas buyers to directly purchase specialty items like Spring Festival pet Tang suits.

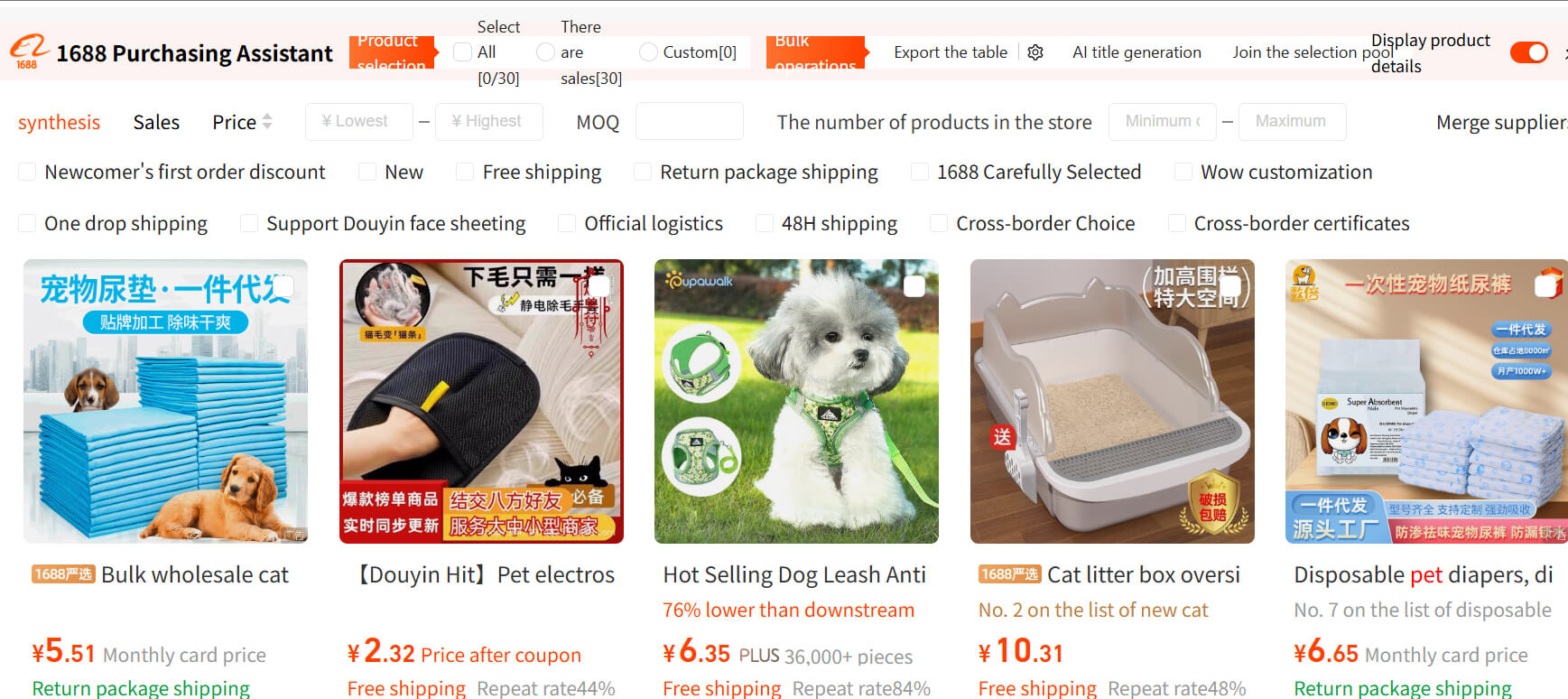

Find Best Pet Supplies factory from 1688

The ability to find the highest-quality pet product manufacturers on 1688 stems from the platform’s systematic advantages in supply chain integration, factory screening mechanisms, industrial clusters, and data transparency.

1. Strict factory certification system

1688 uses a tiered certification mechanism to screen high-quality factories, ensuring the authenticity and production capacity of source manufacturers:

- Super Factory and Powerful Merchant Certification: The platform conducts on-site factory inspections, requiring factories to have production and processing qualifications, scaled-up equipment, and stable supply chains.

- Super Factories represent the top level in the industry (e.g., xxxxx Packaging became a Super Factory through digital transformation and joined the ranks of large-scale enterprises within four years).

- Credibility Passport Tenure Endorsement: The longer a factory has been registered with the Credibility Passport, the higher its credibility. For example, xxxxx Pet Products Factory joined in 2013 and, through a decade of accumulation, has become a benchmark enterprise in industrial-trade integration.

- Source Factory Screening Tool: Buyers can use platform tools to filter out keywords such as “trading companies” and “individual businesses” to exclude intermediaries,

2. Data-Driven Screening and Operational Transparency

The platform provides multi-dimensional dynamic data to assist buyers in making precise decisions:

- Operational Metrics Visualization: Includes the repeat purchase rate over the past 90 days (over 48% for high-quality factories, with an industry average of approximately 30%), refund rate (below 2%), response speed, etc.

- Sales volume and reputation verification: Supports sorting by number of sales transactions and number of buyers. For example, xxx household goods achieved annual sales of 200 million yuan with its upgraded garbage bag model, ranking among the top-selling products.

- Factory inspection reports and VR tours: Users can view factory premises, equipment, and employee scale online (e.g., xxx packaging demonstrates its fully automated production line).

What services Chinese sourcing agent provide to foreign buyers?

As a key bridge connecting international buyers with the Chinese supply chain, Chinese procurement agents provide foreign buyers with professional services covering the entire procurement process.

They not only resolve language, cultural, and compliance barriers in cross-border trade, but also significantly reduce costs and improve efficiency through resource integration.

I. Supplier Development and Management Services

1. Precise Matching and Screening

Based on buyer requirements (product type, quality, budget, etc.), we screen compliant suppliers through localized resource networks (such as industrial clusters, trade shows, and databases), conduct qualification reviews, factory inspections, and production capacity assessments to ensure supplier reliability and suitability.

2. Negotiation and Contract Management

We represent buyers in price negotiations, payment terms (e.g., letter of credit settlement), and delivery schedule discussions, and draft bilingual (Chinese-English) contracts to avoid contractual pitfalls.

II. Procurement Execution and Trade Compliance Services

1. Export Compliance and Document Processing

Handle export customs clearance, prepare invoices/packing lists, apply for certificates of origin, and ensure compliance with destination country standards (e.g., CE, FDA certification) to avoid clearance risks.

III. Quality Control and Logistics Supply Chain Services

1. Full-Process Quality Control

Production Tracking: On-site inspections, mid-term progress checks (e.g., cutting and sewing stages in apparel production).

Final Inspection and Quality Control: Sampling tests conducted according to AQL standards, issuance of Chinese and English inspection reports, and support for return/rework coordination.

2. Integrated Logistics Solutions

Including ocean/air freight booking, container consolidation (LCL), warehouse management, and door-to-door logistics, with particular expertise in handling consolidated shipments for multi-category small-batch orders.

IV. Value-Added and Customized Services

1. Market Insights and Product Development

Provide industry trend reports (e.g., popular product categories in the Middle East), competitive analysis, and assist with new product prototyping and cost optimization (e.g., material substitution solutions).

2. After-Sales and Risk Management

Handle claims, repairs/returns/exchanges, and mitigate buyer default or political risks through credit insurance (e.g., Sinosure).

3. Online and Offline Resource Matching

Exhibition Matchmaking: Act as an agent to facilitate precise negotiations between buyers and exhibitors at events like the Canton Fair and China International Import Expo.

Why choose a Chinese sourcing agent?

- End-to-end cost optimization: Reduce unit prices through bulk purchasing, save on freight costs through consolidated shipping, and increase profit margins through tax compliance.

Risk control: Local teams respond in real time to avoid issues such as “incorrect goods” or supply chain interruptions.

For small and medium-sized buyers, agency services are the preferred low-cost option for testing the Chinese market; for large buyers, they are strategic partners for optimizing global supply chains.